Atal Pension Yojana – Atal Pension Yojana online utility kind at enps.nsdl.com, evaluate APY Contribution Chart, Calculator, Assertion (e-PRAN), apply offline at banks for govt. backed pension scheme for the unorganized sector to supply a minimal month-to-month pension of Rs. 1,000 to Rs. 5,000 after retirement.

The central government has launched Atal Pension Yojana (beforehand Swavalamban Yojana) as a government-backed pension scheme for an unorganized sector. Beneath this scheme, all of the subscribers will get the minimal month-to-month pension of Rs. 1,000 to Rs. 5,000 per thirty days after retirement. Individuals can see APY Subscribers Contribution Chart, Assertion and use APY Calculator to evaluate their pension quantity. candidates can fill Atal Pension Yojana On-line Type at enps.nsdl.com

Central govt. will contribute 50% of the subscriber’s contribution or Rs. 1000 every year (whichever is decrease) for five years. Govt. contribution is restricted just for these people who find themselves non-income taxpayers and are additionally not lined below the Statutory Social Safety Scheme. All of the checking account holders can apply for this APY Scheme and get an assured minimal pension form Govt. of India.

All of the residents who’ve joined the Nationwide Pension Scheme (NPS) are eligible for this APY Scheme. This social safety scheme was launched in June 2015. Pension Fund Regulatory and Growth Authority (PFRDA) administers APY by way of NPS structure.

Table of Contents

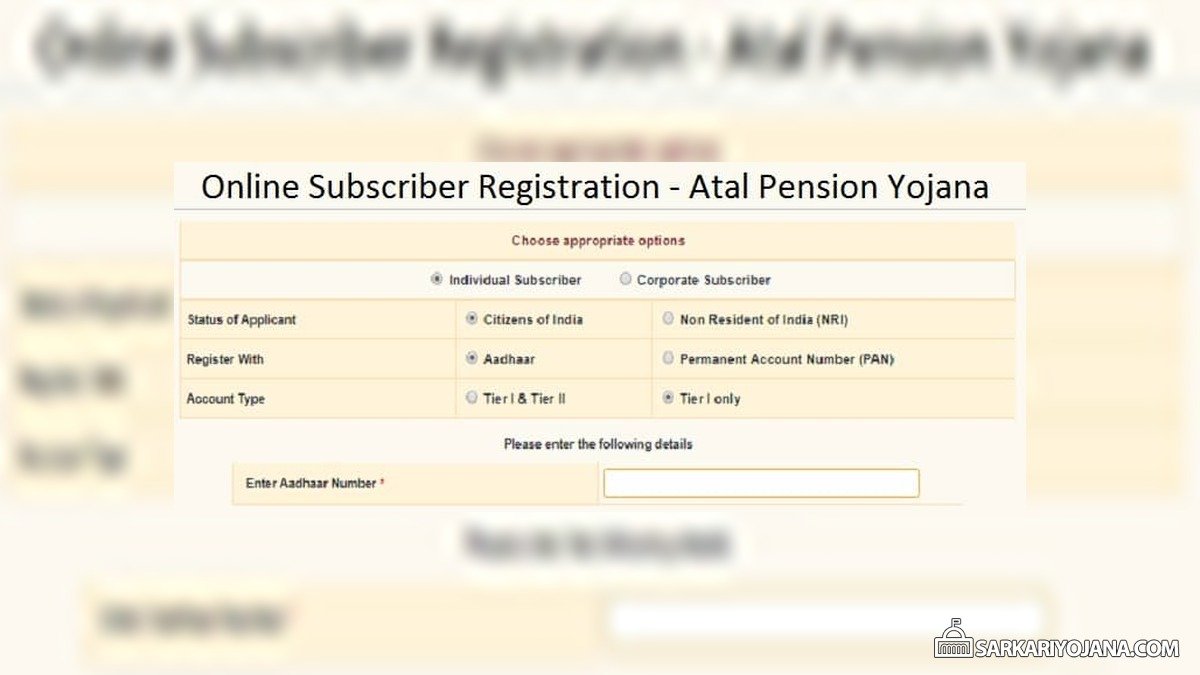

Atal Pension Yojana Apply Online Form

Beneath is the entire process to use on-line and fill Atal pension yojana kind on-line:-

- Firstly go to the official web site enps.nsdl.com

- On the homepage, click on the “Registration” button or instantly click on Online Subscriber Registration

- Right here enter your Aadhaar Quantity and generate OTP in your registered cellular quantity. After getting into OTP, click on the “Proceed” button.

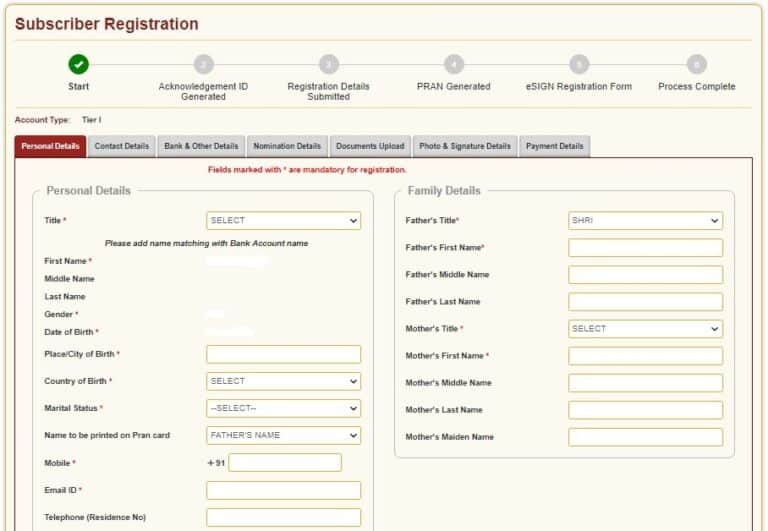

- Afterward, Atal Pension Yojana On-line Utility Type will seem as proven beneath:-

- Now present private particulars, household particulars and generate acknowledgment quantity. After acknowledgment Id is generated, enter financial institution/department particulars & account quantity for financial institution verification.

- Subsequent fill the pension quantity, contribution frequency, nominee and add the supporting paperwork and make the cost to finish the Atal pension yojana online registration course.

If the registration course of is profitable, then the financial institution will debit your account for 1st subscription and can generate Everlasting Retirement Account Quantity (PRAN). Lastly, candidates can e-sign the Atal Pension Yojana On-line kind for verification.

Eligibility Standards for Atal Pension Yojana

The candidates should fulfill the next eligibility standards to avail Atal Pension Yojana Advantages:-

- All of the subscribers have to be an Indian Citizen

- Candidates should lie between 18 to 40 years of age.

- The minimal contribution interval for APY is 20 years after which govt. of India will present an assured minimal pension.

- Aadhaar and Cell quantity are basically really helpful paperwork for KYC of a beneficiary, partner and nominee. Furthermore, for the deal with proof candidates can submit a ration card or financial institution passbook.

All of the candidates can go for a month-to-month pension between Rs. 1000 to Rs. 5000 and guarantee common month-to-month contributions. Along with this, folks can even choose to extend or lower their pension quantity every year (within the month of April). Furthermore, GoI will hyperlink this scheme with PM Jan Dhan Yojana Scheme to routinely deduct the contribution from the checking account.

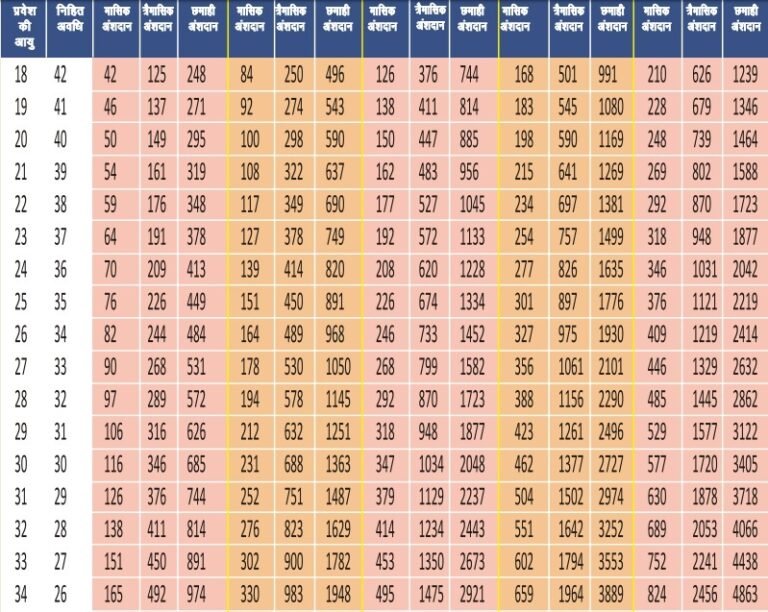

Atal Pension Yojana Chart / Contribution Calculator

Individuals can see the subscriber contribution chart to know the Minimal Assured Pension quantity per thirty days as per the age of their entry. For the month-to-month pension quantity of Rs. 1000 (contribution – Rs. 1.7 lakh), Rs. 2000 (contribution – Rs. 3.four lakh), Rs. 3000 (contribution – Rs. 5.1 lakh), Rs. 4000 (contribution – Rs. 6.Eight lakh) and for Rs. 5000 (contribution – Rs. 8.5 lakh). All of the subscribers can see APY Contribution Chart / Atal Pension Yojana Calculator utilizing the hyperlink given beneath:-

Atal Pension Yojana Subscriber Contribution Chart / Calculator

- The Month-to-month Contribution chart will seem as follows:-

Individuals can enter the APY Scheme at any age between 18 to 40 years and safeguard their future by way of filling Atal Pension Yojana Online Type.

Atal Pension Yojana Assertion

All of the APY subscribers can see the APY Scheme transaction assertion with or without PRAN Quantity. Subscribers having PRAN quantity can enter their Financial institution Account quantity whereas subscribers without PRAN must enter their Identify and Date of Beginning to view APY assertion utilizing the hyperlink given beneath:-

APY Transaction Statement View (e-PRAN)

How To Make APY Registration at Banks

Right here is the entire process to make a registration for Atal Pension Yojana at banks:-

- All of the nationwide banks present the pension yojana, so, you may go to the financial institution with which you’ve got your account and register your self for APY.

- The registration types can be found on-line as talked about above, in addition to, on the financial institution branches. You may obtain the shape and submit it on the financial institution or you may fill and submit it on the financial institution itself.

- Present a sound cellular quantity and fix the photocopy of your Aadhar card.

As soon as your utility is accredited, you’ll obtain an affirmation SMS in your registered cellular quantity.

People Also Read – Social Security Pension Beneficiary Information Rajasthan

Atal Pension Yojana Evaluate

- For more information. on APY Scheme, see scheme particulars in pdf format utilizing the hyperlink given beneath:-

Atal Pension Yojana Scheme Details - Furthermore, candidates can now avail tax advantages in APY Scheme – APY Tax Advantages

- For any additional question, Aadhaar seeding points, grievance redressal, and different associated points, please go to the official web site npscra.nsdl.co.in

I like this website so much it’s really awesome.I have also gone through your other posts too and they are also very much appreciate able and I’m just waiting for your next update to come as I like all your posts.

Thank you for sharing this information. Love your blog post. Please Keep updating. You can also visit our blog for